Financial Wellness

You're not alone...

The statistics are in…

- 78% of Americans live paycheck-to-check

- 73% of employees are distracted at work when stressed

- 50% of Americans can’t come up with $500

- 6 in 10 workers would stay at a job that offered financial benefits

We’re here to help. Understanding your finances is key and we have the resources to make it easy. UICCU has partnered with Banzai to provide the best in financial literacy materials, so that the people of our communities can be better equipped to face the financial challenges life throws their way.

Please take some time to browse the blog articles and resources below to learn more!

Financial Wellness Assessment

Take a step back, analyze your spending, budgeting, and saving habits so you can reflect on how you’re currently managing personal finances. This assessment addresses your individual financial decisions and goals before giving you recommendations on where you can improve and how to get started. It also provides a slew of online resources which have been created specifically to help people gain financial freedom.

Upcoming Webinars

Missed a webinar? Click here to watch previous episodes on YouTube.

Most people have to borrow money at some point, and many struggle to pay it back. But debt is a burden that doesn’t have to break the bank.

Every single time you use credit, the details are added to your credit report and used to influence your credit score.

Using credit can open up big possibilities, but it can also get you in trouble if you aren’t careful.

With the arrival of tax season, comes along the creative ways that scammers use to try and steal your identity.

Finding out that your identity has been stolen can have damaging effects on your life. Here are some tips to protect yourself online and prevent becoming a victim of fraud.

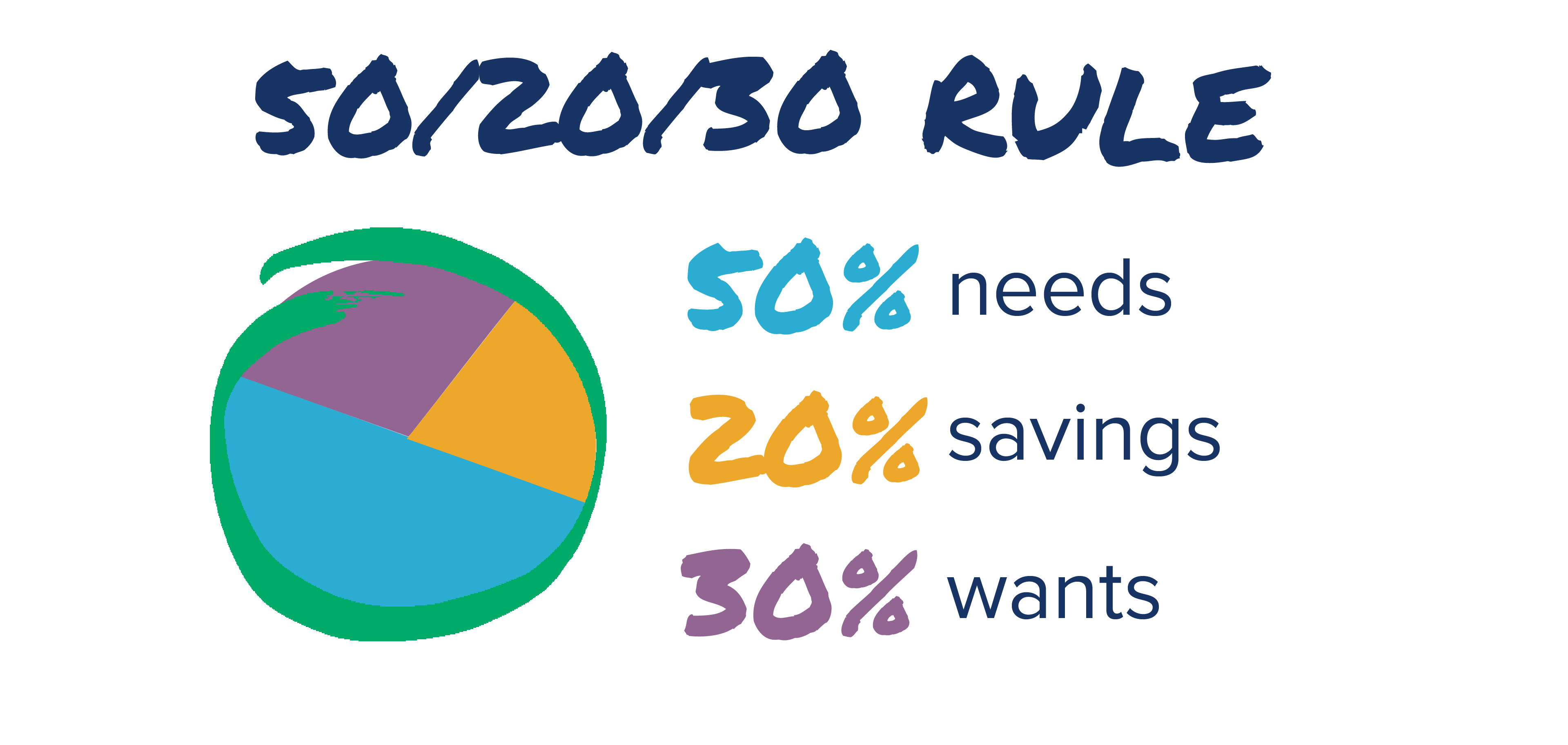

Everyone spends money, but many people don’t know how to track how much they’re spending or how to prioritize it.

Many of us have, at one time or many times, made a New Year’s resolution to start budgeting our money. Good News! Budgeting does not have to be hard!