Many of us have, at one time or many times, made a New Year’s resolution to start budgeting our money. We schedule the date, build a spreadsheet, input the numbers and become overwhelmed when we try to apply our lifestyle to the numbers. I know you have been there and so have I! Good News! Budgeting does not have to be hard!

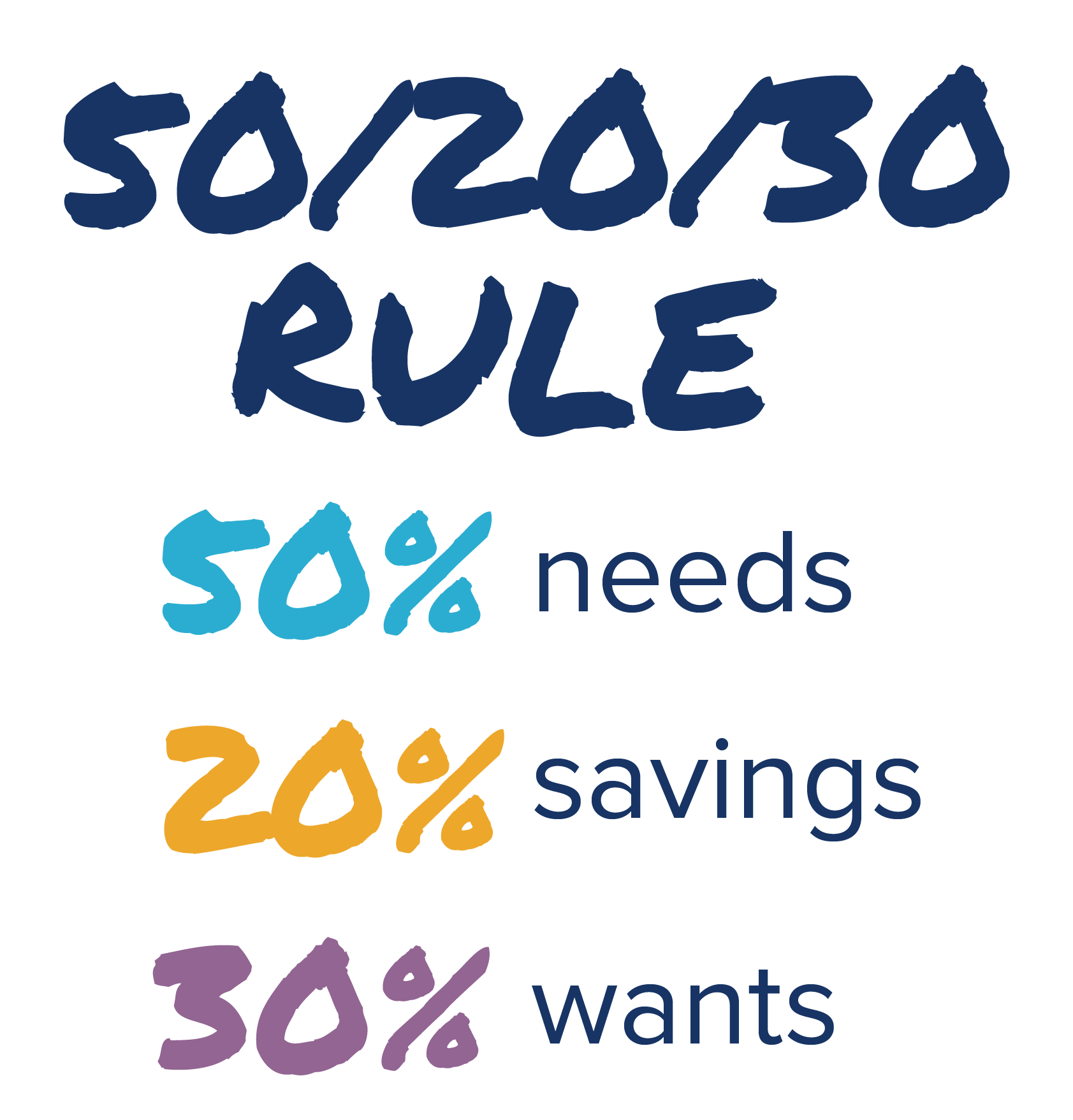

While researching budgeting tools online a few months ago I came across a budgeting plan that made sense to me. Since then I have applied this method to my personal financial goals and shared it with members whom I coach. What is this life changing budgeting method? The 50/20/30 Budget Rule!

The 50/20/30 Budget was popularized by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan. It is an easy-to-follow plan that allocates your after-tax income into 3 primary spending areas: Needs, Savings, and Wants.

- 50% Needs – included are necessary expenses such as housing, utilities, car payment, groceries, insurance (home, car, health)

- 20% Savings – emergency, retirement, or any other specific savings goals.

- 30% Wants – anything that does not fall into either of the other two categories (shopping, eating out, entertainment, etc.)

You may have to adjust the formula based on your specific Needs and that is to be expected. If you find that your Needs require more than 50% of your after-tax income, then balance it with your Wants. Do your best to keep your savings at 20% or at least make that a financial goal.