Visa Credit Cards

Visa Cashback

Introducing the new Visa Cashback Credit Card! Every time you make a purchase with your cashback credit card, you’ll earn a percentage back in cash. Yep – that’s real money back to you! Get 5% cash back on gas & travel, 2% cash back on groceries & restaurants, and 1.5% cash back on everything else5

Rates starting at 15.50% APR

Visa Rewards

Earn points on everyday shopping and redeem those points with UICCU Visa Rewards on the things you love (gift cards, merchandise, travel and more)! It’s like a shopping spree that never ends. AND, get 5x the points on gas & travel, 2x on groceries & restaurants, and 1x on everything else.7

Rates starting at 16.50% APR

Visa Platinum

You’ll find plenty to love about the UICCU Platinum credit card. Great for starting out or consolidating credit card debt. Transfer your balance and enjoy the benefits of our lowest rate card. Making timely payments on the UICCU Visa Platinum credit card can increase your credit score. Enjoy financial freedom again!

Rates starting at 9.9% APR

Student Visa

Our Student Visa® is perfect for full-time college students who are just getting started on their financial journey. Enjoy a fixed credit limit of $1000, no annual fees, no foreign transaction fees, and low interest rate, all while knowing you’re building your credit history with responsible card use. Plus, receive all the same great Visa benefits that our other cardholders receive. Your future self will thank you!

Rates starting at 13.5% APR

![]()

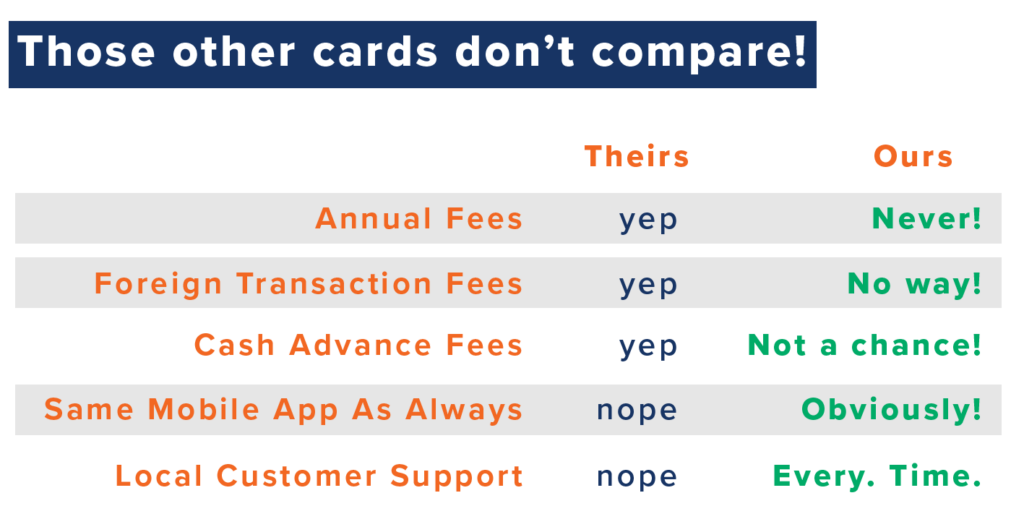

- No Annual Fees

- No Foreign Transactions Fees

![]()

- Card Controls

- Mobile Wallets

- Alerts

![]()

- Travel/Accident Insurance

- Baggage Delay Insurance

- Visa Offers + Perks

- See complete list of benefits

Wanna know more?

1The ANNUAL PERCENTAGE RATE (APR) you receive for the above loan types may vary based on individual credit history, loan term and applicable discounts. All loans subject to credit approval.

3New cardholder accounts are eligible for 10,000 bonus points after spending $500 in purchases within the first 30 days of card issuance. This offer is not available for applicants who have or have had this card. Eligible purchases are purchases for goods and services minus returns and other credits. “Purchases” do not include balance transfers, cash advances, prepaid cards, gift cards, wire transfers, bill pay, similar transfers, or other cash equivalents. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with this offer in any way or that you intend to do so (for example, if you cancel or return purchases you made to meet the required spend), we may not credit bonus points or we may take away points from your account. We may also cancel this Card account. Transactions are subject to the account opening disclosure and your Credit Card Agreement. Allow up to 60 days after qualification period for points to be applied. UICCU reserves the right to refuse any application.

5Qualifying tiers for cashback, bonus cashback and $150 cashback match offer is determined by the merchant code as supplied by the merchant. Bonus cashback to apply to applicable purchases made between the open date and the date the promotional offer is withdrawn. Promotion is subject to be withdrawn at any time. $150 cashback match to apply to applicable purchases made between open date of card and one year after open date of card. Redemption of cash back can begin once $20 or more Available Cashback has been accrued. Available Cashback is viewed and redeemed via transfer by member in Digital Banking platform. “Purchases” do not include cash advances, transfers to existing UICCU card or loan accounts, prepaid cards, gift cards, wire transfers, bill pay, similar transfers or cash equivalents. To be eligible for this offer, account must be open and not in default at the time of fulfillment. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with this offer in any way or that you intend to do so (for example, if you cancel or return purchases you made to meet the required spend), we may not offer cashback. We may also cancel this Card account. Transactions are subject to the account opening disclosure and your Credit Card Agreement. UICCU reserves the right to refuse any application or transaction. Allow up to 60 days for cash back to be applied. Other restrictions may apply.

6Terms and Conditions: APR = Annual Percentage Rate. The promotional APR for balance transfers is for Visa Signature Cashback cards opened or upgraded after 7-1-23 only. There is a fee of 3% of the balance transfer amount for balance transfers processed during this promotional period. The standard rate for purchases, balance transfers processed 12 months after new card open date and any unpaid promotional balance remaining 12 months after new card open date will vary depending on your individual credit worthiness and the current market for Visa Signature Cashback. Rates will adjust with the Prime Rate. If you are requesting UICCU to transfer outstanding credit balances to your UICCU credit line (listed above), finance charges will accrue from the transaction date with no grace period. Allow at least fourteen business days for processing your request(s). Continue to make monthly payments to each creditor until the balance transfer appears as a credit on that account. Transactions are subject to account opening disclosure and your Credit Card Agreement. UICCU reserves the right to refuse any application.

7Qualifying tiers for all rewards points bonuses determined by the merchant code as supplied by the merchant. Bonus points apply to applicable purchases made between 7/1/2024 and 9/30/2024. “Purchases” do not include cash advances, transfers to existing UICCU card accounts, prepaid cards, gift cards, wire transfers, bill pay, similar transfers or cash equivalents. To be eligible for this offer, account must be open and not in default at the time of fulfillment. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with this offer in any way or that you intend to do so (for example, if you cancel or return purchases you made to meet the required spend), we may not credit bonus points or we may take away points from your account. We may also cancel this card account. Transactions are subject to the account opening disclosure and your Credit Card Agreement. UICCU reserves the right to refuse any application or transaction. Allow up to 60 days for bonus points to be applied. Other restrictions may apply.