Introducing the new Visa Cashback Credit Card! Every time you make a purchase with your Cashback credit card, you’ll earn a percentage back in cash. Yep – that’s real money back to you! Want even more money back? We are offering to match your cash back earnings up to $150 for the first year AND 0% APR for 12 months on balance transfers!

for 12 months on balance transfers

Rewarding you for being 100% you

5%

Cash back on gas and travel

2%

Cash back on groceries and restaurants

1.5%

Cash back on everything else5

Cash back isn't the only perk.

Annual Fees?Not this card.

Experience all of the benefits of the Visa Cashback credit card without an annual fee.

No caps.Match up to $150.

Earn cash on all purchases everywhere with no confusing categories and no caps on the amount you can earn.

Low APR ontransfers.

Enjoy a low intro APR on balance transfers.

You do you and earn more cash back.

Use your Visa Cashback for your expenses.

Get cash back on all of your purchases.

Easily redeem your cash.

Frequently Asked Questions

Redeem in Digital Banking, it feels just like a transfer!

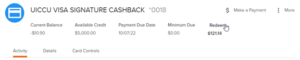

Click “Redeem” in the Card info:

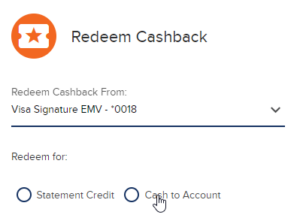

Choose how to redeem!

Redemption can start once you have accrued $20 or more Available Cashback.

No. The full minimum payment amount must still be made by the due date each month.

The minimum credit limit for a Visa Cashback credit card is $5,000.

As long as they are different types of cards (Cashback, Platinum, Rewards, Non-Rewards) you can have multiple cards here. Underwriting will consider your total credit limit available when reviewing your application.

Questions about upgrades from current UICCU rewards cards

Yes. Points will be transferred at a rate of 1 point = $0.01. They will be added to the cash back balance within 60 days of account opening.

Sometimes. Not all merchants will be able to update your card number automatically, so it is best to update your information as you find payments that are still posting with your old card number to avoid any possible issues.

Yes, you will need to set up a new automatic payment transfer in Digital Banking to pay this new card.

You will see your old card in Digital Banking until it closes (15 days after the new card is opened). You’ll see some pending charges on both cards, but they will only post to the new Cashback card.

This will report as an upgrade, so the open date will stay the same.

It will just report a new card number on your credit.

1The ANNUAL PERCENTAGE RATE (APR) you receive for the above loan types may vary based on individual credit history, loan term and applicable discounts. All loans subject to credit approval

5Qualifying tiers for cashback , bonus cashback and $150 cashback match offer is determined by the merchant code as supplied by the merchant. Bonus cashback to apply to applicable purchases made between the open date and the date the promotional offer is withdrawn. Promotion is subject to be withdrawn at any time. $150 cashback match to apply to applicable purchases made between open date of card and one year after open date of card. Redemption of cash back can begin once $20 or more Available Cashback has been accrued. Available Cashback is viewed and redeemed via transfer by member in Digital Banking platform. “Purchases” do not include cash advances, transfers to existing UICCU card or loan accounts, prepaid cards, gift cards, wire transfers, bill pay, similar transfers or cash equivalents. To be eligible for this offer, account must be open and not in default at the time of fulfillment. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with this offer in any way or that you intend to do so (for example, if you cancel or return purchases you made to meet the required spend), we may not offer cashback. We may also cancel this Card account. Transactions are subject to the account opening disclosure and your Credit Card Agreement. UICCU reserves the right to refuse any application or transaction. Allow up to 60 days for cash back to be applied. Other restrictions may apply.

6Terms and Conditions: APR = Annual Percentage Rate. The promotional APR for balance transfers is for Visa Signature Cashback cards opened or upgraded after 7-1-23 only. There is a fee of 3% of the balance transfer amount for balance transfers processed during this promotional period. The standard rate for purchases, balance transfers processed 12 months after new card open date and any unpaid promotional balance remaining 12 months after new card open date will vary depending on your individual credit worthiness and the current market for Visa Signature Cashback. Rates will adjust with the Prime Rate. If you are requesting UICCU to transfer outstanding credit balances to your UICCU credit line (listed above), finance charges will accrue from the transaction date with no grace period. Allow at least fourteen business days for processing your request(s). Continue to make monthly payments to each creditor until the balance transfer appears as a credit on that account. Transactions are subject to account opening disclosure and your Credit Card Agreement. UICCU reserves the right to refuse any application.