Debt Consolidation

Life happens.

Does high-interest debt have you feeling overwhelmed?

Whether you’re carrying a balance on your credit card or medical bills are stacking up, sometimes it feels like you’re drowning. But it doesn’t have to. By consolidating your high-interest debt down to one monthly payment, you could save on interest and pay it off sooner.

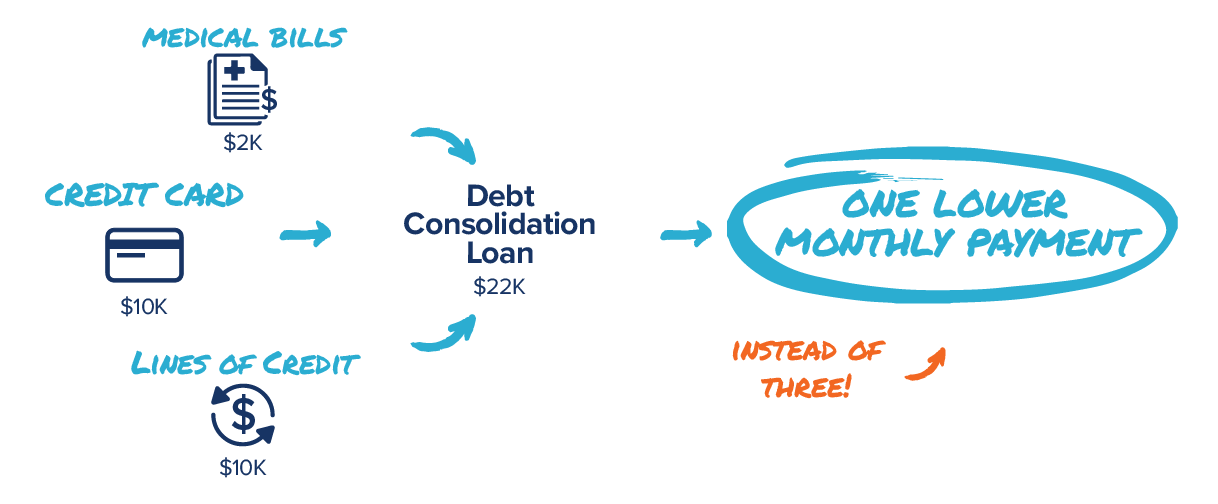

A real-life example for you:

How Debt Consolidation Works

When you have high-interest debt, usually from credit cards, you end up paying a lot of money toward interest. UGH. No one wants that. A debt consolidation loan, also known as a personal loan, will allow you to take your high-interest debt and put them into one loan. Your new loan will give you immediate cash to pay off the high-interest debt you moved into your debt consolidation loan. Your high-interest debt will then be replaced with your new loan allowing you to go from three payments to one payment, like in the example above. If your new debt consolidation loan has a lower interest rate than you were paying on your previous high-interest debt, you could lower your monthly payment, ultimately saving money on interest and likely paying your debt off sooner!

Other benefits of consolidating your debt:

- Making regular on-time payments may help you build your credit score

- Having one monthly payment can help simplify your bills and billing cycles, making the payment process much smoother

- When you pay off large credit card balances, your credit utilization ratio may improve – a huge component of a healthy credit score

Personal loan rates as low as 5% APR* and terms up to 60 months up to $48,000.